benefit details

Sickness Benefit

The National Insurance Sickness Benefit is paid to an insured person who is incapable of working because of sickness or because he is suspected of having a contagious disease and is so certified by a Registered Medical Practitioner.

This benefit is not paid if the incapacity arose from injury on the job. You may however be entitled to the Employment Injury Benefit/s if the incapacity arose from injury on the job.

The National Insurance Maternity Benefit is paid to insured women who are away from work as a result pregnancy.

The benefit comprises a weekly payment of a Maternity Allowance (to maximum of 14 weeks paid in a lump sum) and a Maternity Grant of $3,750.00.

The benefit is not paid if a pregnancy has lasted less than 26 weeks unless the pregnancy resulted in a live birth. You may, however, be entitled to Sickness Benefit.

Allowance and Grant

Who Can Claim:

You can claim for the maternity benefit if:

The maternity benefit includes the maternity grant in the sum of $3,750.00 for each child and the maternity allowance which is based on your average contributions. To qualify for either benefit you must have been employed and paying contributions for 10 out of 13 weeks, (6 weeks before the estimated or actual week of delivery).

The full maternity benefit is paid in the following instances:

You will also qualify for Maternity Benefit if you were in receipt of a Sickness or an Employment Injury Benefit immediately before your maternity period.

When To Apply?

You can apply for this benefit not earlier than the 27th week of pregnancy. However, you must apply within 13 weeks of the actual date of delivery.

How To Apply?

Complete the Application Form NI 12 (Maternity Benefit Application Form) and submit it together with supporting documentation to the NIBTT Service Centre most convenient to you. There, one of our customer service representatives will accept your claim for processing.

NOTE: To submit a claim you must first book an appointment through our Web Appointment portal on NIBTT’s website@www.nibtt.net . Please remember to have the doctor/registered midwife complete Section B of the form, not earlier than the 11th week prior to expected date of delivery. Section C of the form is to be completed by your employer.

Form To Be Completed

NI12 Maternity Benefit Application Form.

NI12A Medical Report Certifying Multiple Births

Supporting Documentation

- Your Birth Certificate if not previously submitted.

- Birth Certificate of the infant(s) original and copy.

- Any supporting affidavit or Deed Poll (where necessary).

- It is mandatory that claimants or third parties submitting claims on behalf of the insured must present some form of original valid identification and a copy of same.

- A Marriage Certificate is required for a married woman whose name has changed since her registration.

- Decree Absolute for divorced women.

- Alternative evidence of confinement, e.g. Birth Certificate of child; letter from attending doctor or registered midwife confirming confinement.

- Proof of employment can take the form of recent pay slips (within the 52-week period prior to the period presented at Section C-Table 1A) or job letters (no earlier than three (3) months) and TD4’s.

- In the case of a midwife certification, a certified copy of the medical certificate/

- Foreign medical certificates must be accompanied by a letter of authentication in respect of the doctor’s status from a member of a Trinidad and Tobago High Commission in the country where medical attention was sought. The responsibility for authenticating the status of the attending doctor rests with the insured.

- In the case of a midwife certification, a certified copy of the medical certificate/report that the claimant submitted to the employer confirming the pregnancy.

- Proof of Account e.g., Bank/Credit Union Statement in claimant’s name.

While proof of employment and the birth certification of the infant(s) and midwife certification are not mandatory submission of same will reduce the processing time of your benefit payment.

Late Applications

You must apply on time to ensure that you receive your benefit.

Time Frames:

| 0-3 Months | Claim on time and can be accepted |

| 3-12 Months | Claim late and may be accepted with good cause |

| 12 Months and over | Claim late and shall be disallowed |

What is Paid?

Effective March 4, 2013, the Maternity Grant was increased to $3,750.00.

The value of the maternity allowance will be determined by the average of the 10 highest contributions in the 14 weeks immediately preceding the start of your maternity period.

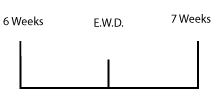

The maternity period begins 6 weeks before your expected week of delivery (E.W.D.).

The earnings class to which this average relates is the class in which your benefit will be paid.

For how long will the Maternity Allowance be paid?

Maternity Allowance is only paid for the period that you are away from the job due to your pregnancy up to a maximum of 14 weeks. That period can begin no earlier than 6 weeks before your week of expected delivery or not later than your actual week of delivery.

Where the woman is away from the job for less than 14 weeks she will be paid only for the period that she is on leave.

What happens if the insured person cannot resume work after the Maternity Benefit period? Where you are medically certified as unable to work due to sickness and you continue to lose earnings, a Sickness Benefit may be paid.

Benefit Credits

While you are receiving the Maternity Allowance neither you nor your employer pay contributions to the NIBTT on your behalf. You will receive benefit credits from the NIBTT as if you were on the job and contributing to the system. These contributions will be awarded in the same earnings class in which your benefit is paid. The benefit credits will ensure that your loss of earnings does not affect the value of your entitlement to further benefits.

Special Maternity Grant

What is the Special Maternity Grant?

The Special Maternity Grant extends coverage to women who would not qualify for a maternity benefit. It is a grant payable to the spouse (whether she is employed, underemployed or unemployed) of an insured man where that spouse is unable to qualify for the Maternity Benefit in her own right.

Who Can Claim?

The spouse of an insured man who is 16 years or older; medically certified as being pregnant for a period of 26 weeks or more by a medical practitioner or registered midwife; or has had a pregnancy of less than 26 weeks that has resulted in a live birth; and who would not have qualified for the benefit in her own right.

To qualify for the benefit the spouse (the insured man) must satisfy the insurability and contribution requirements just as an insured woman who is eligible for the maternity benefit in her own right.

The contributions of the insured man are used to qualify his spouse for the maternity grant. The woman must be the legal spouse or be deemed the common law spouse.

(Common law spouse are persons who are single and living together at the same address for a period not less than 3 years of the insured man)

Forms to be completed –

NI13 – Special Maternity Grant Claim Form

NI12A – For multiple Births

NI4 – Application to Register as an Employed Person – to be completed by the unregistered woman

Other Documents

The following documents must accompany your claim:

- A Marriage Certificate where a legal marriage exists.

- If you are not legally married – a single affidavit sworn to by both you and your husband attesting to –

- Your union

- The duration of your union

- Your individual marital status

- Your addresses (both you and your husband)

- An affidavit from an immediate family member of the father of the child attesting to:

- The union of the parties,

- The duration of the union of the parties,

- The parties individual marital status,

- The addresses of the parties.

- A Certified Registration of Birth from the Registrar of Births and Deaths in respect of the child. Where the father’s name is not on this document an affidavit sworn to by the father attesting to parentage.

- Where you (the uninsured woman) are not an insured person you must submit an NI4 the application to be registered as an insured person.

- Original and copy of a valid PICTURE ID of both the claimant and the person submitting the claim on behalf of the claimant (where applicable) is required for acceptance of the claim.

- Any supporting affidavit or Deed Poll (where necessary).

- A Marriage Certificate is required for a married woman who name has changed since her registration.

- Decree Absolute from divorced men and women.

- Foreign medical certificates must be accompanied by a letter of authentication in respect of the doctor’s status from a member of a Trinidad and Tobago High Commission in the country where medical attention was sought. The responsibility for authenticating the status of the attending doctor rests with the insured.

When to submit?

You may apply for this benefit after your confinement/delivery. However, you must apply within 3 months of the actual date of delivery.

Time Frames:

- 0 – 3 Months Claim on time and can be accepted

- 3-12 Months Claim late and may be accepted with good cause

- 12 Months and over Claim late and shall be disallowed

NOTE: To submit a claim you must first book an appointment through our Web Appointment portal on NIBTT’s website@www.nibtt.net .

What is paid?

The special maternity grant consists of a single payment of $3,750.00 per child.

The National Insurance Funeral Grant is a lump-sum payment made to the person who met the cost of Funeral Expenses of a deceased insured person.

Who Can Claim?

A spouse, a relative, a friend, or the administrator of the estate of the insured person, employer.

The Funeral Grant will be paid only if the insured person:

- Made 25 contributions to the system while engaged in insurable employment or

- Was in receipt of Employment Injury Benefit at the time of death;

- Would have been entitled to receive Employment Injury Benefit but for the fact of death.

insurable employment

Employment in the course of which an employed person renders services to his employer for remuneration which equals or exceeds the sum of one hundred and twenty ($120.00) dollars a week.

Form To Be Completed

NI8 Funeral Grant Claim Form

Supporting Documentation

- Death Certificate.

- Bills/receipts for funeral expenses.

- National Insurance Registration Card of the deceased.

- Original and copy of a valid PICTURE ID of both the claimant and the person submitting the claim on behalf of the claimant (where applicable) is required for acceptance of the claim.

When To Apply?

The claim must be submitted to the Service Centre within 3 months of the date of death of the insured person.

Late Applications

You must apply on time to ensure that you receive your benefit. Any claim submitted later than the stipulated 3 months can result in your claim being disqualified, unless you can show good cause for the delay in submission. Your explanation must be submitted in writing. Even with good cause, if your claim is made more than 12 months after the death of the insured, the benefit shall be forfeited.

Time Frames

- 0-3 Months – Claim on time and can be accepted.

- 3-12 Months – Claim late and may be accepted with good cause

- 12 Months and over – Claim late and shall be disallowed.

How To Apply?

Submit your claim to the NIBTT Service Centre most convenient to you. There, one of our customer service representatives will accept your claim for processing.

How Much Will Be Paid?

Effective March 4, 2013 the Funeral Grant is a lump-sum payment of 7,500.00.

The National Insurance Invalidity Benefit is paid to an insured person who is medically certified as an invalid and who has made the required number of contributions to the system.

An invalid is a person who is likely to remain incapable of working for a period of not less than 12 months because of a specific disease or bodily or mental disablement.

Who Can Claim:

Insured persons who are under the age of 60 and certified as an invalid by a medical practitioner, and who have made any of the following mix of contributions to the system:-

How To Apply?

Complete the application for Invalidity Benefit Form N.I. 38 and return it to the NIBTT Service Centre most convenient to you. There, one of our customer service representatives will accept your claim for processing.

Requirements when filling the N.I. 38 Form

To complete the form you must: –

- Complete Section A of the Form.

- Take the form to your medical practitioner who must complete Section B.

- Take the completed form together with supporting documents to the Service Centre.

Supporting Documentation

- Your Birth certificate if not previously submitted.

- Any supporting affidavit or Deed Poll (to support your given or acquired name).

- Marriage Certificate is required for a married woman whose name has changed since her registration with the National Insurance System.

- A Decree Absolute from a divorced woman where necessary.

- Foreign medicals will only be accepted where the duration, start date of illness and ailment are clearly stated and the attending doctor signs, dates and stamps the form. Such medicals must be accompanied by a letter of authentication from a Trinidad and Tobago High Commission or Embassy in the country in which the treatment was received. The responsibility for authenticating the status of the attending doctor rests with the insured.

- Original and copy of a valid PICTURE ID of both the claimant and the person submitting the claim on behalf of the claimant (where applicable) is required for acceptance of the claim.

Alternative Evidence of Date of Birth

Where you are unable to submit your Birth Certificate, the NIBTT may in special circumstances accept, as alternative evidence of age, documents for which the presentation of a Birth Certificate maybe a requirement for issue. These will include: –

- A valid passport.

- A valid driver’s permit.

- A valid Electoral Identification Card.

- Naturalisation records.

- Baptismal certificate (registered within 1 year of birth).

- Religious records.

- School Records.

- Armed Forces discharge record.

- Self-sworn affidavit (as a last resort).

Alternative Evidence of Employment

Where contributions may be outstanding on your behalf, you may be asked to supply alternative evidence of employment such as:

- TD4 slips.

- Pay slips.

- Record of service for computing employment-related Retiring Benefits (daily and monthly paid public servants).

- Pension and Leave Records.

- Record of service for computing severance benefit.

- Letter from employer providing detailed information.

- Assessment Notice from the Board of Inland Revenue.

When To Apply?

You must apply for the benefit within 3 months of the first day of being certified as being an invalid by your doctor.

NOTE: To submit a claim you must first book an appointment through our Web Appointment portal on NIBTT’s website@www.nibtt.net .

Late Applications

You must apply on time to ensure that you receive your benefit. Failure to submit your claim to the NIBTT within 3 months of the start of your illness or loss of income can result in you losing all or part of your benefit. You may lose any period that is more than3 months before the NIBTT receives your claim unless you can show there was good cause for the delay in submission. Your explanation must be submitted in writing.

If your claim is made more than 12 months after the start of your illness or loss of earnings, the benefit shall be forfeited.

How Much Will Be Paid?

The value of your Invalidity Benefit will be determined by the average rate of all the contributions you have paid based on the contribution requirements outlined in the section.

Who Can Claim.

The earnings class to which this average rate corresponds is the class in which your benefit will be paid.

Where you have paid more than 750 contributions, one increment will be added to the basic invalidity pension for every block of 25 additional contributions paid in excess of 750. If your invalidity has not ceased by the time you have reached 60 years, you may apply for the retirement pension at age 60 whether or not you have made 750 contributions.

Where you have made less than 750 contributions, including benefit credits, the Retirement Pension will be paid at the same rate as the Invalidity Pension.

Where you have made more than 750 contributions, including benefit credits, your Retirement Pension will be calculated and paid in accordance with the NI Act, and the basic Retirement Pension will be enhanced by increments as applicable.

Where you may have qualified for Invalidity Benefit prior to May 3, 1999 and your incapacity does not cease at age 60 years, you will be paid Retirement Pension, from age 60, in the same amount paid as Invalidity Pension.

Benefit Credits

While you are receiving the Invalidity Benefit you will receive benefit credits from the NIBTT as if you were on the job and contributing to the system. These contributions will be awarded in the same earnings class in which your benefit is paid. The benefit credits will help to ensure that your loss of earnings does not affect your entitlement to the retirement pension.

The National Insurance Retirement Benefit is designed to supplement the income of individuals after retirement.

Every employee who has paid National Insurance contributions is entitled to a Retirement Benefit.

You qualify for the Retirement Benefit at any time between the ages of 60 and 65 if you are retired or at age 65 whether you retire or not.

The Benefit may be either:

A Retirement Pension payable for life to persons who have 750 contributions or more – the minimum requirement for a basic pension; or

A Retirement Grant, which is a one time lump sum payment, subject to a minimum sum of $3,000.00 paid to persons who have made less than 750 weekly contributions the minimum requirement for a basic pension.

Who Can Claim?

Anyone who is insured under the system and who has attained age 60 years and has retired or at any age between 60 and 65 years that he or she retires; or who is aged 65 whether retired or not.

What Are The Qualifying Conditions?

You must have reached Retirement Age.

The insured person who is age 65 years will receive the benefit whether he/she stops working or not.

The insured person who is between 60 to under 65 years will receive the benefit if he ceases to be in insurable employment and will continue to receive such pension even if he returns to insurable employment before he attains age 65.

Have a minimum of 750 contributions to his or her credit. The contributions may comprise of paid contributions inclusive of Voluntary Contributions, Age Credits and or Benefit Credits.

Forms To Be Completed

NI 82 – Retirement Benefit Application

NI 65 – Life Certificate

All of these forms are available FREE of charge at any National Insurance Service Centre or are downloadable.

Supporting Documentation

- Birth Certificate.

- Any supporting Affidavit or Deed Poll where necessary.

- Marriage Certificate for Married /Divorced Women.

- A Decree Absolute from Divorced Women.

- Late Claim Letter giving exceptional circumstances why claim is being made late.

- Valid PICTURE ID of both the claimant and the person submitting the claim on behalf of the claimant (where applicable) is required for acceptance of the claim.

Alternative Evidence of Date of Birth

Where you are unable to submit your birth certificate the NIBTT may, in special circumstances, accept as alternative evidence of age, documents for which the presentation of a birth certificate is a requirement for issue. These will include:

Where contributions may be outstanding on your behalf, you may be asked to supply alternative evidence of employment such as:

When To Apply?

A Claim to Retirement Benefit may be submitted about three months before:

- Your 65th Birthday if you are not retired.

- Your 60th Birthday if you retire at age 60 or before.

- The date on which you plan to retire if you are between 60 and 65 years of age and still employed. Your Claim must be submitted no later than 12 MONTHS from your date of retirement if you are between 60 and 65 years of age or your 65th birthday whether retired or not.

How Much Will Be Paid?

Retirement Pension

An average rate of contribution is calculated by considering all the contributions paid. The earnings class to which this average rate corresponds is the class in which the benefit will be paid. Where the insured person was in receipt of the Retirement Pension prior to the appointed day, benefit rates were converted.

Remember: For every block of 25 contributions paid in excess of 750 one increment is added to the basic pension rate. Notwithstanding the benefit rates in respect of retirement pension the board shall pay with effect from February 1, 2012 the sum of $3,000.00 monthly, as a pension to each person qualifying for a Retirement Pension.

Retirement Grant

- Where the insured person reached retirement age on or after 07/01/2008. The retirement grant will be equal to 3 times the value of total contributions, subject to a minimum of $3,000.00.

- Where the insured person reached retirement age on or after 10/4/75 the Retirement Grant is equal to 3 times the value of the total contributions paid by both employer and employee, subject to a minimum of $200.00.

- Where the insured person reached retirement age between 10/4/72 and 9/4/75 the Retirement Grant is equal to 5 times the value of the total contributions paid by both the employer and the employee, subject to a minimum of $200.00.

For How Long Will The Benefit Be Paid?

Retirement Pension Payment

Payment of Retirement Pension will start from the Monday of the week in which Retirement Age was reached and continues on a monthly basis for life Payment for each month. It will be deposited to the claimant’s bank account on the 16th day of the preceding month.

Retirement Grant Payment

Retirement Grant is one time lump-sum payment. There will be no further payments to the insured.

NOTE: Age Credits are not used to calculate the Retirement Grant. Actual total contributions paid are used to calculate the Retirement Grant.

NOTE: Age Credits are not used to calculate the Retirement Grant. Actual total contributions paid are used to calculate the Retirement Grant.

The National Insurance Employment Injury Benefit is paid to an insured person who is rendered incapable of work through personal injury caused by an accident, which arises out of and in the course of his employment, or through a prescribed industrial disease caused by the nature of his employment.

What is Employment Injury Benefit

Employment Injury Benefit is a unique benefit in that it consists of four (4) categories of benefit:

Injury Allowance Benefit – payable for 52 calendar weeks.

Disablement Benefit – consists of either a monthly benefit or a lump sum payment.

Medical Expenses – a cash benefit to defray related medical expenses.

Death Benefit – monthly benefit payable to the spouse, dependent parents and dependent children.

Injury Allowance

Payment of the benefit is made to:

- An insured person who suffered personal injury caused by an accident which arises out of and in the course of his/her employment.

- An insured person who is required to abstain from work because they are suspected of carrying a contagious disease or who has had contact with a case of infectious disease or an insured person who is rendered incapable of work through a prescribed industrial disease caused by the nature of his job; or

- To the dependents of an insured person who dies as a result of such an injury on the job.

Who Can Claim?

Anyone who is in insurable employment in relation to Employment Injury Benefits (that is where a person is employed and a contribution was paid or due to have been paid for that week of employment) and:-

- Is away from the job because of an accident/disease that arose out of or in the course of employment;

- Is required to abstain from work because they are suspected of carrying a contagious disease or who has had c ontact with a case of infectious disease

- Is incapable of work for a period of more than 3 days as a result of the injury or prescribed industrial disease.

A claim must be submitted to the Service Center nearest to you within 14 days of the injury for the Injury Benefit and 12 months for the Death Benefit.

Time Frames:

- 0 – 14 days – Claim on time and can be accepted

- 14 days – 12 months Claim late and may be accepted with good cause

- 12 months and over Claim late and shall be disallowed

Forms To Be Completed

NI19– Application for Injury Benefit

NI19A– Medical Certificate for continuing injury/disease

Supporting Documentation

- Marriage Certificate for a woman whose name has changed since her registration.

- Foreign medical certificates must be accompanied by a letter of authentication.

- Late Claim Letter showing good cause which caused the claim to be made late.

- Original and copy of a valid PICTURE ID of both the claimant and the person submitting the claim on behalf of the claimant (where applicable) is required for acceptance of the claim.

When To Apply

The insured person must apply for the benefit within 14 days of the date of the accident or development of the disease. Late submission of a claim can result in loss of the benefit. The date of development of the industrial disease is the date on which the insured person was rendered incapable of work as result of the disease.

NOTE: Please note: The National Insurance Board will not entertain a claim for Injury Benefit before the 4th day of incapacity.

How Much Will Be Paid?

The class of contribution in the week of the accident and the week prior will be considered. Benefit will be paid in the higher class. However, unpaid apprentices and persons in receipt of a receipt of a Retirement Pension who have returned to work will be paid in the lowest Earnings Class – Class 1.

Late Applications

You must apply on time to ensure that you receive your benefit. Failure to submit your claim to the Board within 13 weeks (3 months) of the start of your injury can result in you losing all or part of your benefit. You may lose any period that is more than 13 weeks (3 months) earlier than the date on which the Board receives your claim unless you can show there was good cause for the delay in submission. Your explanation must be submitted in writing. Even with good cause you may still lose your benefit.

Even with good cause, if your claim is made more than 12 months after the start of your injury the benefit shall be forfeited.

For How Long Will Injury Benefit be Paid?

Where the period of incapacity lasts for more than three (3) days, payment will be made from the 1st day of incapacity and may continue for a maximum of 52 calendar weeks.

What Happens after Injury Benefit?

At the end of the injury benefit period the extent of disability is immediately assessed to determine the insured person’s entitlement to Disablement Benefit.

Medical Expenses

Medical expenses are paid for employment injury to an insured person who is rendered incapable of work through personal injury caused by an accident, which arises out of and during his employment, or through a prescribed industrial disease caused by the nature of his employment. Medical Expenses are paid to an insured person who incurs the cost of medical treatment for the personal injury or prescribed industrial disease up to a maximum of $28,125.00 per injury. Prior to March 04 2013, the maximum amount payable was $22,500.00.

Medical Expenses include the following: –

- Doctor’s Fees.

- The cost of Drugs and Dressings.

- Hospital Expenses.

- Operations.

- The cost of necessary para-medical treatment e.g. physiotherapy, appliances.

- The cost of travel incidental to an insured person receiving care and treatment.

- Constant care and Attendance Allowance (regular or periodic care as recommended by the attending doctor).

Who Can Claim?

You may make a claim for medical expenses where, as an insured person, you are eligible to receive Injury Benefit. Medical Expenses are payable for as long as you can produce evidence from the doctor that you are under treatment for the particular injury and/or disease which are derived from an accident, up to the maximum allowance of $28,125.00. Medical Expenses will not be paid in circumstances where the employer has met such costs.

Time Frames:

- 0 – 3 months Claim on time and can be accepted

- 3 – 12 months Claim late and may be accepted with good cause

- 12 months and over Claim late and shall be disallowed

Form To Be Completed

NI 114 – Application for Medical Expenses.

Required Documentation

The expenses must relate to medical attention you received for injuries caused by an accident arising out of and in the course of your employment or for a prescribed industrial disease. The following documents must be submitted to support your claim:

- Bills and receipts for any of the medical expenses identified above.

- Foreign medical certificates must be accompanied by a letter of authentication in respect of the doctor’s status from a Notary Public in the country where medical attention was sought or a member of a Trinidad and Tobago High Commission. The responsibility for authenticating the status of the attending doctor rests with the insured.

- Any referral letters to specialist or Paramedical Practitioner for foreign treatment.

The following information must be shown on the receipt from pharmacy:

- Pharmacy Number.

- Name of doctor.

- Name of patient/claimant.

- Date of prescription.

Para-medical treatment/equipment:

Effective March 01 2004, the NIBTT began accepting a certificate from a Paramedical Practitioner for Employment Injury Benefit claims only if the insured was referred by a medical practitioner with a written proof of referral.

A Paramedical Practitioner is a person who is not a Medical Practitioner but supplements and supports medical work and includes a Chiropractor, Physiotherapist, Dental Technician or Psychologist.

Required Documentation

- A letter of referral from the attending doctor recommending treatment and/or equipment to be provided by a particular person/institution MUST be produced.

- Where the attending doctor himself administers such para- medical treatment or provides para-medical equipment, a letter of referral is not required.

- Where expenses are incurred for para-medical treatment/equipment provided while the claimant is hospitalised, such expenses must be considered.

Cost of Travel

- The full name of the claimant should be written on each bill/receipt in addition to Vehicle Registration Number, Date and Amount.

- The normal route-taxi fares are to be applied in normal circumstances.

- Where you use your own car, reimbursement in relation to route-taxi fares will be paid.

- If there is doubt whether hired transport should have been used, the claimant may be asked to obtain a statement from his doctor to this effect.

- Where under Traveling Expenses a claim is made for the traveling expense of an escort, the claimant must submit a letter from the attending doctor certifying that there was a need for an escort. Where an escort is used on the day of the injury to accompany the claimant to the doctor’s office/hospital, then the above will be waived for that day only, depending on the nature and extent of the injury.

Medical Expenses – Constant Care and Attendance Allowance

Medical expenses are paid for employment injury to an insured person who is rendered incapable of work through personal injury caused by an accident, which arises out of and during his employment, or through a prescribed industrial disease caused by the nature of his employment.

Documentation

- A certificate from the attending doctor, advising that constant care and attendance is required, and the period for which same is required.

- A statement from the person or institution (e.g. convalescent home) providing the care, indicating the period(s) for which the services were rendered.

When To Apply?

You must apply for the benefit within 3 months of the date on which the expenses were incurred.

Late Applications

You must apply on time to ensure that you receive your benefit. Failure to submit your claim to the Board within 3 months of incurring the medical expense can result in you losing all or part of your benefit. You may lose benefit for any expense incurred that is more than 3 months earlier than the date on which the Board receives your claim unless you can show there was good cause for the delay in submission. Your explanation must be submitted in writing. Even with good cause you may still lose your benefit.

Even with good cause, if your claim is made more than 12 months after incurring the expense the benefit shall be forfeited.

How To Apply?

Submit your claim to the NIBTT Service Centre most convenient to you. There, one of our customer service representatives will accept your claim for processing.

How Much Will Be Paid

There are limits in each category with the maximum amount payable as medical expenses for an injury being $28,500.00.

Disablement Benefit

The Disablement Benefit is compensation paid to an insured person for the loss of physical or mental faculties including disfigurement, whether or not it is accompanied by loss of faculties, caused by an accident on the job.

Such an accident on the job must arise out of or in the course of your employment, or through a prescribed industrial disease caused by the nature of your job. This Benefit is paid whether you return to your job or not.

The Disablement Benefit consists of two categories:

- The Disablement Pension – This benefit is paid until the disability ceases.

- The Disablement Grant – This grant is paid as one lump-sum payment.

Who Can Claim?

An insured person who has been injured on the job and/or has received the Injury Benefit for any period, up to a maximum of 52 calendar weeks, and is medically assessed as having suffered a disability or loss of faculties based on an injury on the job.

Forms To Be Completed

NI119 Disablement Benefit Claim Form

Time Frames

You must apply for the benefit within 3 months of the date of the last Injury Benefit payment or from the date on which the accident occurred.

- 0-3 – Months – Claim on time and can be accepted

- 3-12 – Months – Claim late and may be accepted with good cause

- 12 – Months and Over Claim late and shall be disallowed

You must apply on time to ensure that you receive your benefit. Failure to submit your claim to the NIBTT within 3 months of the start of your disability can result in you losing all or part of your benefit. You may lose any period that is more than 3 months earlier than the date on which the NIBTT receives your claim unless you can show there was good cause for the delay in submission. Your explanation must be submitted in writing. Even with good cause you may still lose your benefit.

The loss of benefit will be as follows:-

In the case of Disablement Grant.

The entire Grant, unless the claimant can show that, throughout the period between the effective date of the contingency and the date on which the NIBTT received the claim, good cause existed for delay in submission of the claim.

In the case of Disablement Pension.

The loss of benefit for any period more than 6 months from the date on which the NIBTT receives the claim. Even with good cause you may still lose your benefit. If your claim is made more than 12 months after the start of your disablement, you shall lose the benefit.

Disablement Pension

You will receive a disablement pension if your doctor assesses the extent of loss of faculties or disability as 20% and over.

Where your assessment is a multiple of five, for example 25%, it will be treated as the next highest percentage that is a multiple of 10, in this case 30%.

Similarly, where your assessment is not a multiple of five it will be treated as the nearer percentage, which is a multiple of 10. For example, an assessment of 28% will be treated as 30% but an assessment of 24% will be treated as 20%.

If you are receiving a Disablement Pension and are hospitalised for necessary care, your disablement will be assessed as 100% during the period of hospitalisation.

How To Apply?

Submit your claim to the NIBTT Service Centre most convenient to you. There, one of our customer service representatives will accept your claim for processing.

How Much Will Be Paid?

You will be paid a percentage of the Injury Benefit you were receiving based on your Earnings Class. The percentage paid will be the percentage of disability assessed by your doctor.

For How Long Will Disablement Pension Be Paid?

You will receive your benefit for as long as the disability continues. The NIBTT may review a medical assessment of disablement and pay that later assessment if it is different from the earlier one.

Disablement Grant

This benefit is one lump-sum payment made where the extent of disablement is assessed at less than 20%. Where your disablement is assessed at 3% or less, 3% will be paid.

How much will be paid?

The lump-sum payment will be paid. The formula for calculating the Disablement Grant is: n% Disablement x number of weeks of Disability not exceeding 365 weeks x half the assumed earnings.

If you are already in receipt of Disablement Benefit and submit a subsequent claim for Disablement arising out of a new injury for which you are assessed at 20% or more, you shall be required to be re-assessed to establish a total permanent partial disability taking into account all injuries suffered and the current Disability Benefit revised to reflect the new assessment.

Death Benefit

What is Employment Injury Death Benefit?

The Death Benefit is a payment or periodical payments made to specific survivors of a deceased insured person who died as a result of an accident or of a prescribed industrial disease arising out of or in the course of employment.

Employer’s Responsibility

The employer must certify that death occurred as a result of the accident/prescribed industrial disease.

Who Can Claim?

You can claim the Death Benefit if you are one of the following five types of dependants:-

- Widow legal/common law

- Widower legal/common law

- Children

- Orphans

- Dependent parent(s)

In order to qualify the dependents must provide documentary evidence to prove their relationship to the deceased insured person.

Widow/Widower

The benefit is paid to the lawful spouse of the Insured person (the spouse is lawful even if separated from the Insured person).

Common-Law Spouse

As a Common-Law Spouse you will be paid the benefit if both you and the Insured person were legally single persons, living together as husband and wife up to the date of death of the insured person for a minimum of 3 years. A single person is one who was never married or, if married, was released from the marriage due to death of the Insured person or a decree of divorce absolute. A Common Law spouse may be either nominated or not nominated as beneficiary by the insured prior to his or her death. The official Nomination of Beneficiary form is Form NI42.

Where you were not nominated as beneficiary you must provide alternative evidence of nomination and evidence of cohabitation for 3 years prior to the death of the insured person.

Form To Be Completed

NI117 Employment Injury Death Benefit Claim Form

Supporting Documentation

- Death Certificate of deceased insured person

- Birth Certificate of widow and eligible children

- Medical Certificate for mentally or physically disabled child

- Medical Certificate for pregnant spouse, certifying pregnancy and expected date of confinement.

- N.I. Registration Card of deceased and

- Marriage Certificate for Legally Married Persons

- Original and copy of a valid PICTURE ID of both the claimant and the person submitting the claim on behalf of the claimant (where applicable) is required for acceptance of the claim.

For Common Law (Nominated)

- Evidence of single status of claimant and deceased

- Decree Absolute or relevant Death Certificate if either party was previously married to another person.

For Common-Law Situations (Not Nominated)

- Evidence of single status of claimant and deceased

- Evidence of common-law relationship, i.e. evidence of three years of cohabitation up to the time of death

- Decree Absolute or relevant Death Certificate if either party was previously married to another person.

For Dependent Parents

- Evidence of support of dependent parent

- Birth certificate of the deceased

For Common Law (Spouse)

The following are some examples of documents you may use as alternative evidence of nomination.

- Will – claimant is indicated as spouse/beneficiary.

- Employer’s Pension Plan – claimant recorded as spouse/beneficiary.

- Life Insurance Policy – claimant indicated as spouse/beneficiary.

- Credit Union document – claimant indicated as spouse/beneficiary.

- Deed – in both parties names.

- Birth Certificate of child – both parties named.

- Joint Account – Statement in both parties names

- Statutory Declarations from 3 prominent people in the community to attest to knowledge of common law relationship

In addition, such claims will be advertised in the newspaper once per week for three consecutive weeks. If no objection is lodged by a spouse of either party and all other qualifying conditions are met, you will be paid the benefit as the widow/widower of the deceased insured.

Alternative Evidence of Paternity for Child Allowance

The following are some examples of documents you may use as alternative Evidence of Paternity when the father’s name is not inserted on the Birth Certificate of the child.

- Marriage Certificate of Parents.

- Paternity order given by a court.

- Adoption Certificate where child is adopted.

- Evidence of pregnancy at date of death of insured father and birth certificate when child is born.

When To Apply?

You must apply for the benefit within 12 months of the date of death of the insured person.

Late Applications

You must apply on time to ensure that you receive your benefit. Failure to submit your claim to the Board within 12 months from the date of death of the insured person may result in the benefit being paid from the date it was received by the Board, unless you can show there was good cause for the delay in submission. Your explanation must be submitted in writing.

How To Apply?

Submit your claim to the NIBTT Service Centre most convenient to you. There, one of our customer service representatives will accept your claim for processing.

How Much Will Be Paid?

The value of the Death Benefit will be determined by the rate of contribution paid by your spouse in the week of his or her death arising out of the injury on the job or to the rate of Employment Injury Benefit that your spouse was receiving.

Payments are made in the following categories: –

A Widow Or Widower’s Pension to a surviving spouse – legal or common law.

A Child Allowance to a dependent child/step-child, adopted child of the deceased insured person. Effective from March 04, 2013 a child will receive a minimum of $600.00 per month.

A Dependent Parent’s Allowance is paid to a parent who was wholly or mainly maintained by the deceased insured. Effective March 04, 2013 the dependent parents will each receive a minimum of $300.00 monthly if one parent is alive he or she will receive $600.00 monthly.

For How Long Will The Benefit Be Paid?

Effective 1st March 2004:

- The Widow is paid for life or until she remarries. The benefit will be stopped upon remarriage. A remarriage grant will then be paid.

- The widower is paid for life or until he remarries. The benefit will be stopped upon remarriage. A remarriage grant will then be paid. The remarriage grant is equal to 52 weeks of benefit.

- Children will be paid until age 19 years or until the cessation of disability where the child’s disability occurred before 19th birthday provided also that such disabled child is unable to work.

Children must be legally single (unmarried). A stepchild is a child of the surviving spouse who was resident in the home at the time of the death of the insured person and who was wholly or partially maintained by the insured person.

The benefit will also be paid to a child who was in the mother’s womb at the time of the father’s death.

You will receive an allowance for that child from the first day of the contribution week of date of his or her birth.

The dependant parent will be paid for life or until he or she remarries.

In cases where the benefit is paid to both parents and one parent dies, the total benefit will be paid to the surviving parent.

Remarriage Grant

The Remarriage Grant is a category of Survivor’s Benefit. Should you remarry while still receiving your payment as the surviving spouse of a deceased insured person you will be paid a Remarriage Grant.

A lump-sum payment is paid on remarriage of of a person who was in receipt of the widow or widower’s pension or Death Benefit equal to 12 months or 52 weeks payment of the particular Survivor’s Benefit.

You will no longer receive a pension for yourself but you will continue to receive payments for any dependent children who are still eligible for a child allowance.

The National Insurance Survivors’ Benefit is a periodical payment made to specific dependents of an insured person who dies otherwise than by way of employment injury.

Who Can Claim

A widow or widower – whether legally married or Common Law

Child/step-child or adopted child (including orphans) or

Dependent parent of a deceased insured who has made a minimum of 50 contributions to the system.

Common-Law Spouse

As a Common-Law Spouse you will be paid the benefit if both of you were both legally single persons living together as husband and wife up to the date of death of the insured person. A Common Law spouse should be nominated as beneficiary by the insured prior to his or her death. The official Nomination of Beneficiary form is Form NI 42.

Where you were not nominated as beneficiary you must provide alternative evidence of nomination and evidence of cohabitation for 3 years prior to the death of the insured person.

You must supply three (3) affidavits from reputable persons in the community attesting to the fact that you both lived a common law situation for 3 years or more.

These may be supported by:

- Will – claimant is indicated as spouse/beneficiary.

- Employer’s Pension Plan – claimant recorded as spouse/beneficiary.

- Life Insurance Policy – claimant indicated as spouse/beneficiary.

- Credit Union document – claimant indicated as spouse/beneficiary.

- Deed – in both parties’ names.

- Birth Certificate of child – both parties’ names.

- Joint Account Statement in both parties’ names.

In addition, such claims will be advertised in the newspaper once per week for three consecutive weeks. If no objection is lodged by a spouse of either party or by the immediate family of the deceased insured and all other qualifying conditions are met, you will be paid your benefit.

Form To Be Completed

NI 51 – Survivors’ Benefit Claim Form

Supporting Documentation

The following are some examples of documents you may use as alternative evidence of nomination.

- Death Certificate of deceased insured person

- Medical Certificate for mentally or physically disabled child

- Medical Certificate for pregnant spouse, certifying pregnancy and expected date of confinement.

- N.I. Registration Card of deceased

- Birth Certificate of Widow and Eligible Children

- For Legally Married Persons a Marriage Certificate

- For Common Law (Nominated)

- Nomination Form

- Decree Absolute or relevant Death Certificate where one or both of the parties was/were previously married

- For Common-Law Situations (Not Nominated)

- Evidence of marital status of claimant and deceased

- Evidence of common-law relationship, i.e. evidence of three years of cohabitation up to the time of death

- Decree Absolute where one or both of the parties was/were previously married

- For Dependent Parents

- Evidence of support of dependent parent(s) by the insured person

- Birth Certificate of the deceased insured person

- Alternative Evidence of Nomination for Common Law Spouse

- Original and copy of a valid PICTURE ID of both the claimant and the person submitting the claim on behalf of the claimant (where applicable) is required for acceptance of the claim.

Alternative Evidence for Child Allowance

The following are some examples of documents you may use as alternative Evidence of Paternity when the father’s name is not inserted on the Birth Certificate of the child.

- Marriage Certificate of Parents

- Birth Certificate of child

- Paternity Order

- Adoption Certificate where child is adopted

- Evidence of pregnancy at date of death of insured father and birth certificate when child was born

- Statutory Declaration from a relative of the deceased for example the mother

What are the Qualifying Conditions?

The deceased insured person must have made a minimum of 50 contributions. In cases where the deceased insured person died before attaining their 60th birthday and has a minimum of 50 contributions the benefit will be paid to his/her survivors.

When To Apply

You must apply for the benefit within 12 months of the date of death of the insured person.

Late Applications

You must apply on time to ensure that you receive your benefit. Failure to submit your claim to the Board within 12 months of the date of death of the insured person can result in you losing your benefit for any period earlier than 12 months before the date on which the Board receives your claim unless you can show there was good cause for the delay in submission. Your explanation must be submitted in writing.<

How To Apply?

Submit your claim to the NIBTT Service Centre most convenient to you. There, one of our Customers Service Representatives will accept your claim for processing.

How Much Will Be Paid?

Effective March 4, 2013, increases in survivor’s benefit payments are made in the following categories.

- Widow Or Widower’s Pension to a surviving spouse will receive a minimum of $600.00 per month.

- A Child Allowance to a dependent child/step-child, adopted child of the deceased insured person. Effective March 4, 2013, a child will receive a minimum of $600.00 per month.

- Where both parents were insured persons and are deceased the child will receive no less than $1,200.00 per month.

- A Dependent Parent Allowance to a parent who was wholly or mainly maintained by the deceased insured will received $600.00.

The rate of survivors benefit paid based on the death of an insured person will be determined by the earnings class of the average of all the contributions paid by the insured person.

This benefit rate is shared between all the survivors in a ratio established in the regulations as follows – 60 % for the surviving spouse (Widow/Widower) and the rest is shared among any dependant children and/or parent. Not withstanding this, a child will receive a minimum of $600.00 per month.

For How Long Will The Benefit Be Paid

A Dependent Parent Allowance to a parent(s) who were wholly or mainly maintained by the deceased insured will be paid for life or until he/she remarries.

The Widow or Widower is paid for life or until remarriage.

The Widower will be paid for life or until he remarries

The dependant child/step-child/adopted child will be paid until age 19.

Children must be legally single. A stepchild is a child of the surviving spouse who was resident in the home at the time of the death of the insured person and who was wholly or partially maintained by the insured person.

The benefit will also be paid to a child who was in the mother’s womb at the time of the father’s death. You will receive an allowance for that child from the Monday of the date of his or her birth.

The dependant parent will be paid for life or until he or she remarries

Should you remarry while still receiving your payment as the surviving spouse of a deceased insured person you will be paid a Remarriage Grant. You will no longer receive a pension for yourself but you will continue to receive payments for any dependent children who are still eligible for a child allowance.